Headlines

This week saw the continuation of predominately bearish price trends across gas and power wholesale contracts, noting the on-going marked disparity between day-ahead contracts and those further out on the forward curve. All tracked GB wholesale contracts saw losses week-on-week, the noteworthy exception being the day-ahead power contract. Day-ahead gas fell 6.4% to 102.00p/th, amid continued higher levels of LNG imports reaching UK terminals, softening the near-term gas supply balance and periods of warmer weather reducing heating consumption on average. On the contrary, day-ahead power rose 28.6% to £135.00/MWh, with periods of lower wind outturn tightening system margins. Elsewhere, December 22 gas was down 18.6% at 245.00p/th, and January 23 gas decreased 13.8% to 290.00p/th. All seasonal gas contracts declined this week, down by 6.5% on average, while both summer 23 and winter 23 gas dropped 11.9% and 6.1% respectively, subsiding to 260.00p/th and 294.00p/th. Like gas, seasonal power contracts declined this week, down on average by 8.9%, as summer 23 power decreased 13.0% to £235.00/MWh, while winter 23 fell 7.3% to £278.00/MWh.

Baseload electricity

Forward curve comparison

- Day-ahead power rose 28.6% to £135.00/MWh, despite losses from its equivalent gas contracts, but was ultimately supported by much lower wind outturn – expected to extend into next week.

- December 22 power slipped 23.0% at £258.00/MWh and January 23 power decreased 25.2% to £505.00/MWh.

Annual October contract

- Q123 power moved 27.9% lower to £400.00/MWh.

- The annual April 23 contract lost 10.0% to £256.50/MWh, 222.6% higher than the same time last year (£79.50/MWh).

Peak electricity

Forward curve comparison

- Day-ahead peak power was down 13.4% to £155.80/MWh, following baseload power lower.

- December 22 peak power declined 14.4% at £376.85/MWh, and January 23 peak power decreased 16.1% to £910.5/MWh.

Annual October contract

- The annual April 23 peak power rose 5.8% to £337.33/MWh

- This is 289.1% higher than the same time last year (86.7/MWh).

Seasonal power prices

Seasonal baseload power contracts

- All tracked seasonal power contracts declined this week, down on average by 8.9%.

- Summer 23 power decreased 10.0% to £270.00/MWh, while winter 23 fell 4.8% to £300.00/MWh.

Seasonal baseload power curve

- Most seasonal peak power contracts declined this week too, down 6.1% on average.

- Summer 23 and winter 23 peak power dropped 7.8% and 4.4% respectively, falling to £286.35/MWh and £388.30/MWh.

Commodity price movements

Oil and coal

- Brent crude prices climbed marginally, up 0.7% to average $95.83/bl, a third consecutive week of average price rises.

- Higher Chinese crude imports supported prices in the week, noting China is the largest crude importer globally. Easing Covid-19 restrictions in the week also helped ease previous concerns over a drop in demand.

- Elsewhere, a prominent lever of price rises for Brent crude remains centred around the 2mn/bpd cuts introduced from 1 November introduced by OPEC+ members.

Carbon (UK and EU ETS)

- EU and UK ETS prices saw collective bearish movements this week. EU ETS slipped 4.2% to average €74.81/t, whilst UK ETS carbon decreased 3.4% to £72.76/t.

- Reducing gas prices in the UK and the continent drove lower prices across both schemes in part, supporting clean spark spreads.

- On the contrary, we still continue to also observe strong bullish momentum on longer dated EUA contracts, providing some bullish sentiment to prices in the near-term and pegging back any sustained price losses.

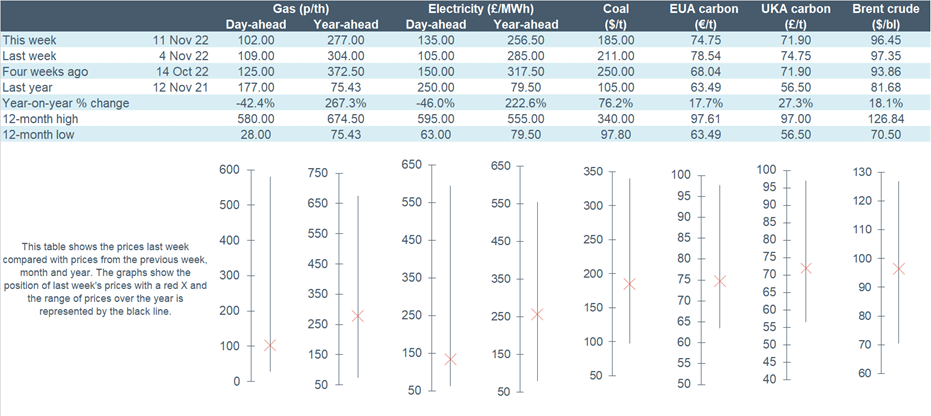

Wholesale price snapshot – Friday-on Friday